are funeral expenses tax deductible in ireland

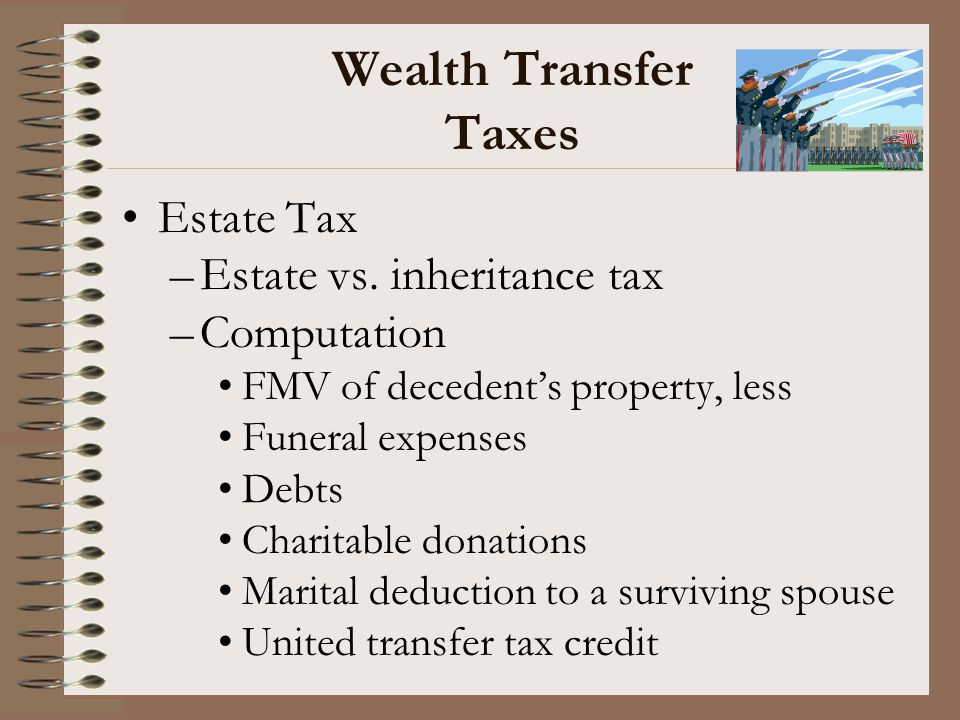

To have the funeral expenses deducted from the estates tax obligation the return must be filed within nine months of the estate owners passing. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

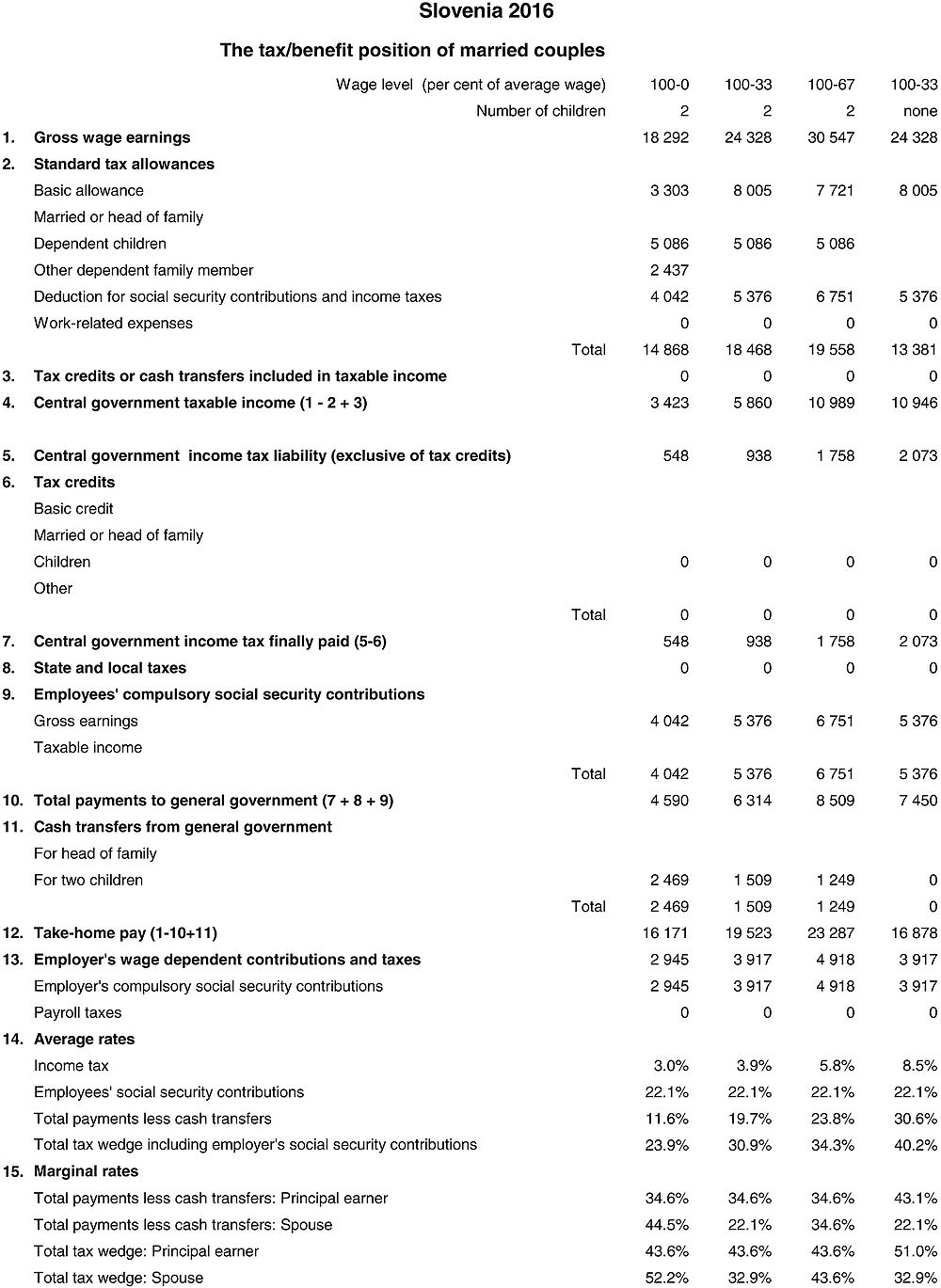

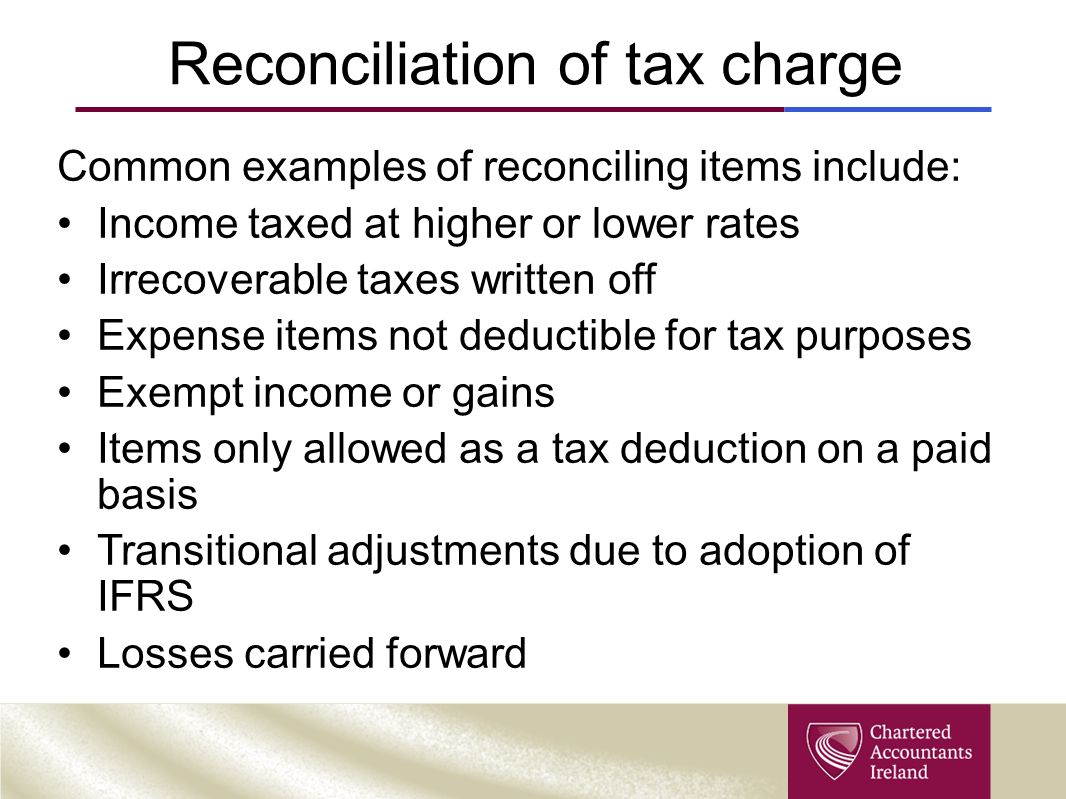

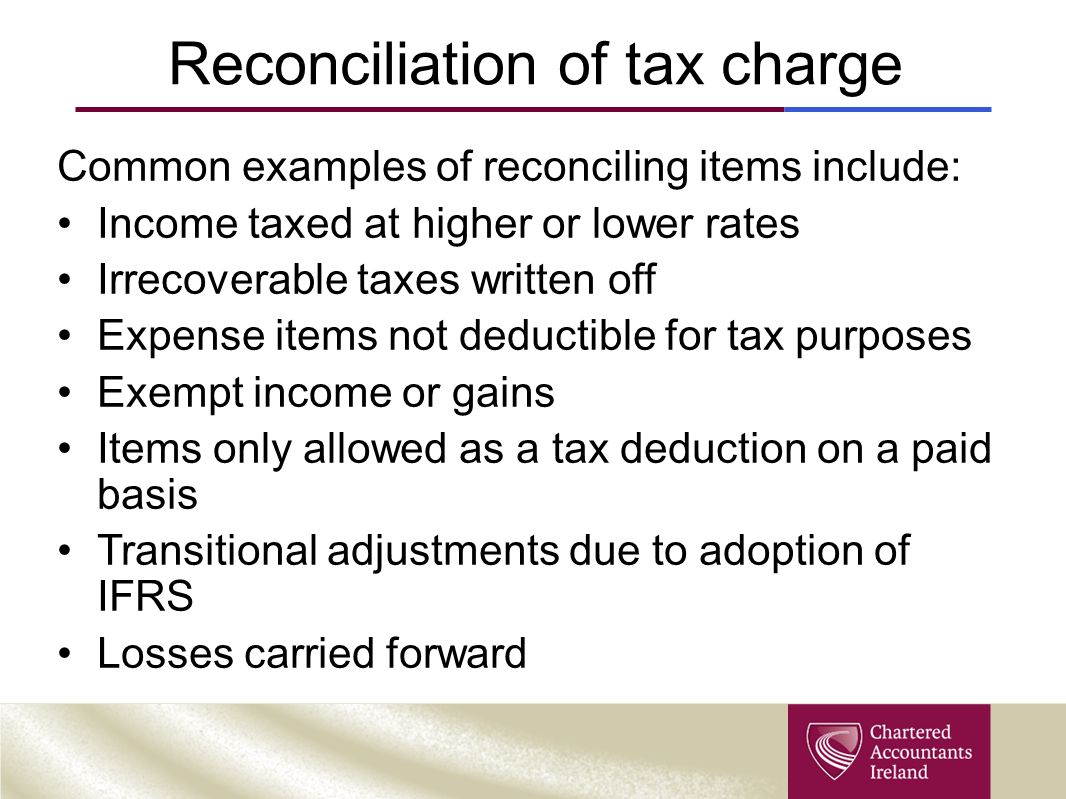

Module 6 Accounting For Tax Ruth Ni Dhonduin Ppt Download

Can I deduct funeral expenses probate fees or fees to administer the estate.

. For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form. You must work out how much of the expenditure was for business purposes and claim a deduction. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

In some cases a funeral may be partially or fully paid for in advance or the funeral costs are covered by an insurance policy. The IRS recognizes business travel as a legitimate tax deduction. They are never deductible if they are paid by an individual taxpayer.

Tax relief is capped at 10 of total income for that year. Debts of the deceased due at the date of death and funeral expenses. However if the expenses are paid from an individuals estate that it will be tax-deductible.

In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. March 30 2021. Along with estates valued at over 5 million estates that have generated income totaling over 600 must also file a.

The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. Schedule JFuneral Expenses and Expenses Incurred in Administering Property Subject to Claimsis the proper place to enter the expenses. Last reviewed - 01 July 2021.

Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. An itemized funeral expense list will allow you to deduct money spent on funeral expenses such as embalming cremation casket storage hearses limousines and florals. Funeral expenses are not tax-deductible.

If you can combine a business trip with attending a funeral you can write off some of. Contributions to personal pension plans retirement annuity contracts are allowable as a deduction for self-employed. Unlike any other expense funeral expenses cant be deducted for income tax purposes whether the money is spent directly by a person or by the estate.

Capital items expensed to a companys profit and loss account are also not tax-deductible. Funeral expenses paid by your estate including cremation may be tax-deductible. The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body. While the IRS allows deductions for medical expenses funeral costs are not included. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible.

Minister or other officiant costs. In short these expenses are not eligible to be claimed on a 1040 tax form. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate.

IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one. These are personal expenses and cannot be deducted. What funeral expenses are tax deductible.

Professional services of a funeral home and funeral director. It is important to note that where the taxable value exceeds the relevant threshold the entire estate is liable to tax. If you choose to report funeral expenses on the estates tax return use form 706.

You may be eligible for an Exceptional Needs Payment to help you with the cost of a funeral if your income is low. Expenses that are for both business and private use. Expenses that may be deducted from taxable income are those that are incurred wholly and exclusively for the purposes of the tradebusiness.

What funeral expenses are tax deductible. The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying the body. Burial or funeral insurance is tax-deductible or not is a commonly asked question.

Funeral expenses should be itemized on Line 1 Section A and the total of the expense should be entered under Total If the estate was reimbursed for. In general expenses incurred wholly and exclusively for the purposes of the trade are tax-deductible. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

General accruals and provisions are not tax-deductible. Funeral costs can vary widely depending on what you opt for and depending on whether it is a city or country funeral rural funeral costs are generally less expensive. The answer may disappoint you.

These expenses may include. This cost is only tax-deductible when paid for by an estate. This would include items such as phone bills motor expenses and rent.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. Otherwise the person who arranges the funeral must pay the funeral director for the cost of the funeral. Funeral Costs as Qualifying Expenses.

In arriving at the taxable value of the estate the following deductions from the gross estate are allowable. If you spend money on something that is for both business and private use you can claim a deduction for part of the expense. Funeral expenses are not tax deductible because they are not qualified medical expenses.

The IRS deducts qualified medical expenses. Qualified medical expenses include. This can be repaid from the deceaseds estate the money and property the person left behind.

No never can funeral expenses be claimed on taxes as a deduction. 30 of the value of agricultural land and buildings. In other words funeral expenses are tax deductible if they are covered by an estate.

Burial plots and vaults. According to IRS an individual taxpayer may. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible.

The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Corporate - Deductions. Most of the individuals cant claim burial expenses as tax-deductible.

Individual taxpayers cannot deduct funeral expenses on their tax return. The estate itself must also be large enough to accrue tax liability in order to claim the deduction. Deductible medical expenses may include but are not limited to the following.

Placement of the cremains in a cremation urn or cremation burial plot.

Module 6 Accounting For Tax Ruth Ni Dhonduin Ppt Download

International Page 3383 Ictsd Org

International Page 3383 Ictsd Org

Top Organizations That Help With Funeral Expenses

Acct 440 Welcome To Taxation Of Business Entities Dr Efrat Ppt Download

Is The Medicare Premium Taxable Rules Income Limits And More

Module 6 Accounting For Tax Ruth Ni Dhonduin Ppt Download

Can I Deduct Health Insurance Premiums It Depends

International Page 3383 Ictsd Org

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Covid 19 Qualified Disaster Relief Payments Bkd

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos